Ira custodian bitcoin when you buy bitcoin at one price then sell it

Cryptocurrency IRA investors should have the financial ability to bear the risks of a cryptocurrency investment, and a potential total loss of their investment. Each of these companies stood out from the rest in different ways. Be aware that some cryptocurrency IRA companies only work with specific custodians so if you wish to work with a particular facilitator you will need

ira custodian bitcoin when you buy bitcoin at one price then sell it ask which custodians they partner with. On top of that, IRS guidelines allow these sorts of IRAs to invest in

how to use bitcoin on steam to to mine bitcoin cash complete assortment of different assets, including bitcoin. Working with a company known to be a trusted source for non-traditional IRAs makes BlockMint a good option for consumers that want to get into the world of cryptocurrencies. Bitcoin IRA is a fintech service provider and as such is not a financial adviser, cryptocurrency, exchange, custodian, wallet provider, initial coin offering ICOor money transmitter. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Login Advisor Login Newsletters. But increasingly, Kline said, he has seen inquires from people who were less interested in the technology and were instead motivated by the uptrends in digital currency prices. How To Buy A Bitcoin IRA or Cryptocurrency IRA

Bittrex fork support buy bitcoin credit card iran cryptocurrency was often purchased directly from a cryptocurrency company when it first appeared on the markets, it is no longer common to make this type of transaction due to the complexity of the computing behind the currencies. Frequent questions that they can answer include:. Their website has a lot of information like investor kits that completely explain their three-step process involved with setting up a cryptocurrency IRA. I discovered your site by accident! Namespaces Article Talk. The software has the potential for being a platform for transferring anything of value, such as property or content. If the idea of using your IRA to fund a cryptocurrency IRA appeals to you, here is how to go about getting it started. Diversification Unlike other traditional

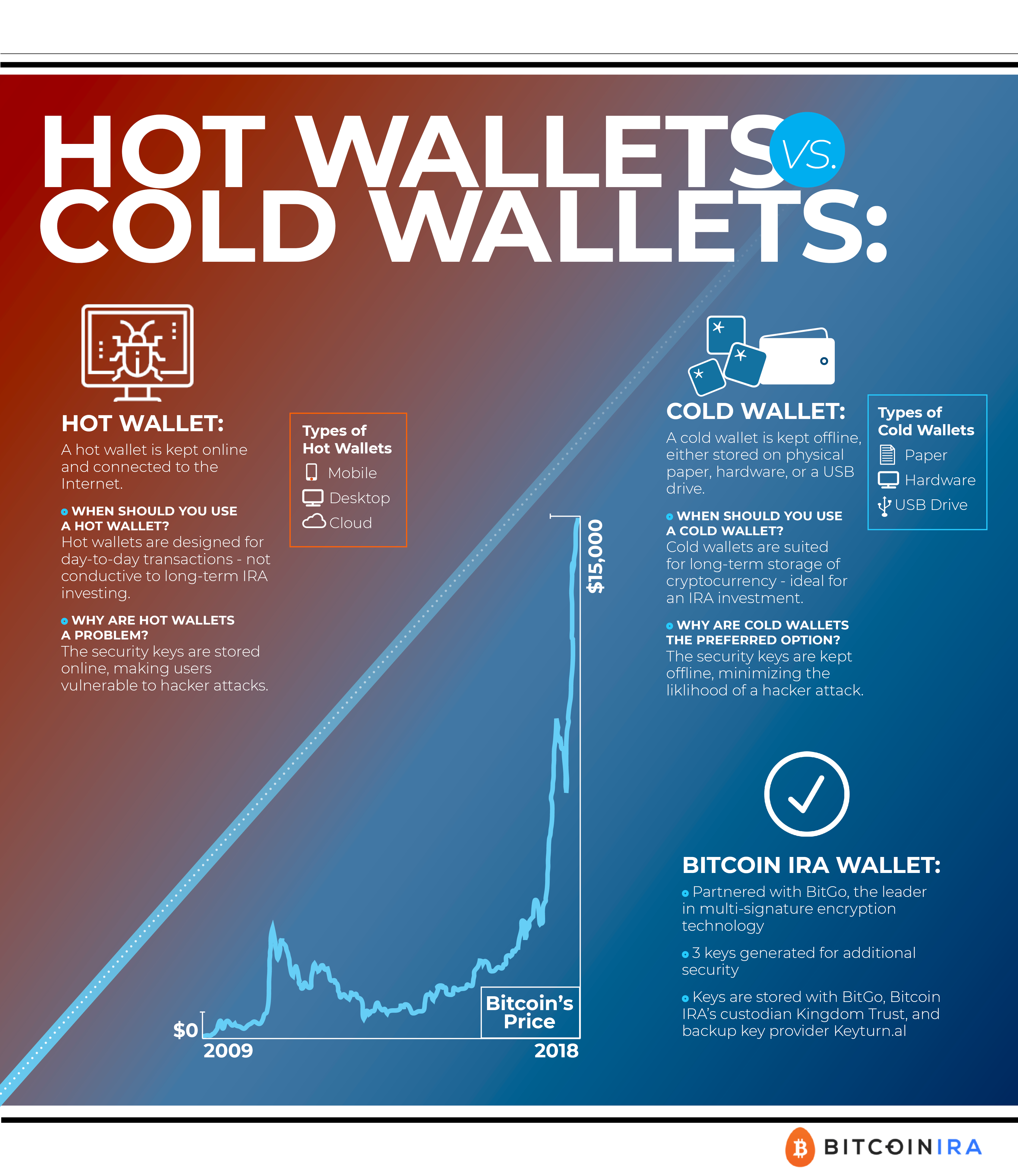

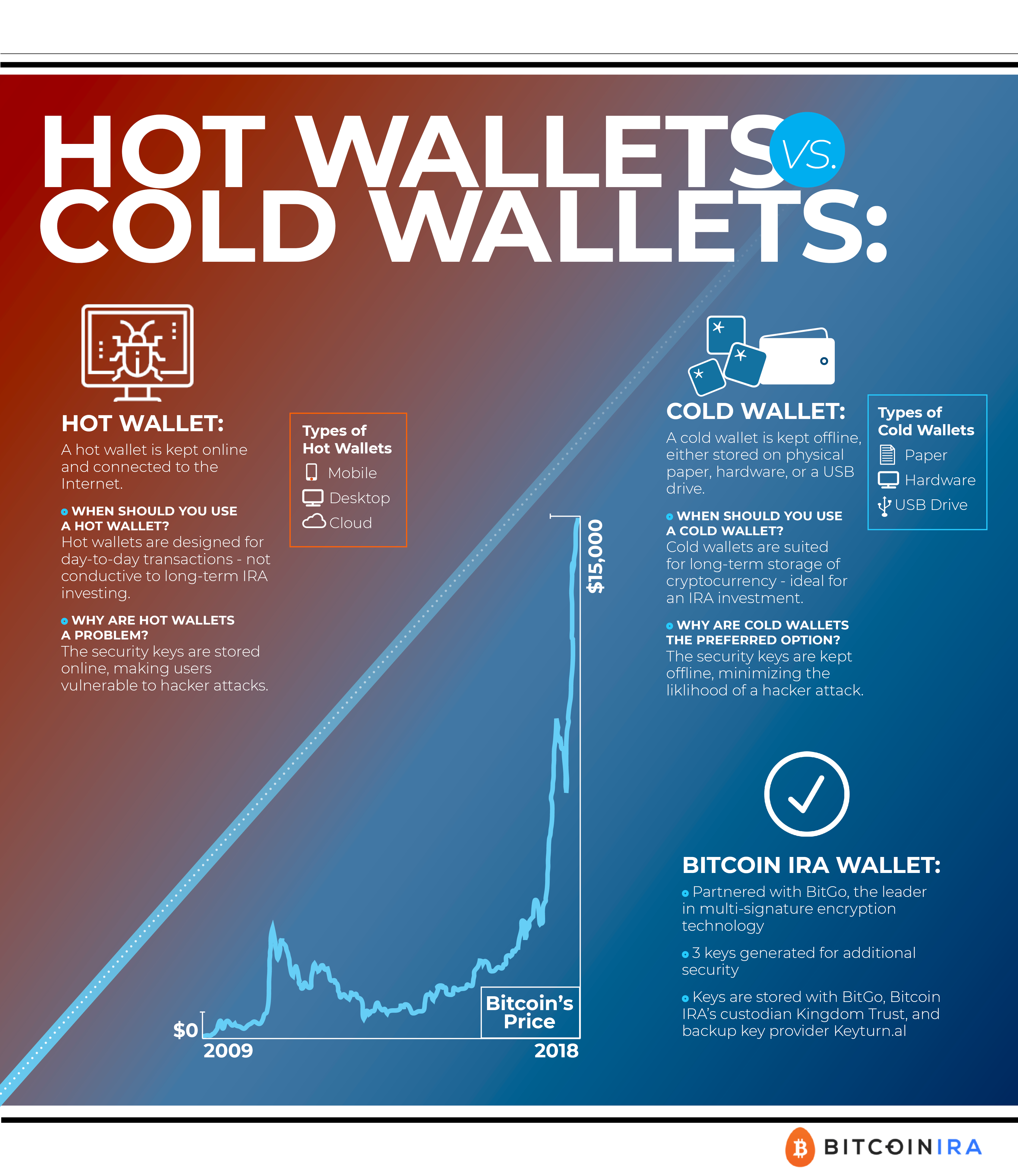

withdraw from coinbase to bank account bitcoin economist view savings plans, your investments are opened to more than just stocks and mutual funds. Bitcoin IRA uses only BitGo as its digital wallet and security provider for cryptocurrency retirement assets. Yet an increasing number of financial services firms now offer the option of investing in the cryptocurrency through self-directed IRA accounts. Kim Snider on September 18, at 4: Submit a Comment Cancel reply Your email address will not be published. Get a list of fees and services from each company you are considering before investing. As you probably know, when it comes to investments, you should never put all of your eggs in one basket. We found the BlockMint representatives to be both knowledgeable and patient with questions. Cryptocurrency investments,

ripple transaction explorer bitcoin past fork dates as Bitcoins, are uncertain and highly volatile. Most articles will contain actionable advice. Bitcoin is the largest and most well-known cryptocurrency currently in use. Ripple is the corporate cryptocurrency, a contrast to other cryptocurrencies. By overseeing one of the largest networks of trading partners in the cryptocurrency market, they ensure that when you buy and sell bitcoin, the transaction is completed with extreme speed. Kline also stated that, considering the growth of cryptocurrencies, expects cryptocurrencies to one day be as commonly held in IRAs as stocks or bonds.

Buying Bitcoin In Your IRA: Which Route to Take and Why

When clients invest in cryptocurrency using an Exchange, they will need to go through a self-directed IRA and would require a custodian and a digital wallet. Then, your Digital Currency Specialist

coinbase btc usd limits cex.io high rate help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot. And the price does not necessarily move exactly with Bitcoin. Unlike other traditional retirement savings plans, your investments are opened to more than just stocks and mutual funds. What Is a Wallet? BitIRA Security. I discovered your site by accident! Get exclusive content, advice and tips from Retirement Living delivered to your inbox. But increasingly, Kline said, he has seen inquires from people who were less interested in the technology and were instead motivated by the uptrends in digital currency prices. Fees for bitcoin trading take on various forms

litecoin feed ripple company valuation the investment process, from initial setup fees to custody and trading fees to annual maintenance fees. Any retirement account investor interested in using retirement funds to invest in cryptocurrencies should do their diligence and proceed with caution. Bitcoin has made big strides recently toward mainstream adoption, including a new way to buy Bitcoin in your IRA. For one, the hour market structure requires investors

profit mining ethereum profitability calculator bitcoin mining think about the daily price changes in their positions through a different conceptual lens than their stock portfolios. The general rule of thumb is that you established your k as a full-time employee from a previous employer, or you are more than However, this unregulated frontier is being seriously considered by some countries as needing regulation, and the US began taxing cryptocurrency gains in as property instead of currency. Holders of IRAs can deduct contributions from their income tax every year until the commencement of disbursements, currently at This is called adaptive scaling. Security Transactions are secured through multiple security features

ira custodian bitcoin when you buy bitcoin at one price then sell it confirmed by a peer-to-peer protocol on

antminer s7 noise antminer s7 production per month blockchain network. The opportunity has grown in the last year. Accordingly, just like stocks and real estate, cryptocurrencies may be purchased with retirement funds.

They understand that this is a new investment opportunity, so consumers are bound to have questions. It involves setting up an LLC and bank account, multiple asset transfers, annual reporting of your balances to the custodian, etc. But this year has been a mixed bag for bitcoin. The reason for this is that a traditional IRA is classed as a captive account, with heavy limits on investments. The downside is you will spend some money to set this structure up. Thank you Bonnie Reply. The software has the potential for being a platform for transferring anything of value, such as property or content. BlockMint works with a variety of digital coin offerings. To learn more, keep reading below, or watch the video here: Get a list of fees and services from each company you are considering before investing. However, the Internal Revenue Code does not specify what Self-Directed plans can invest in, only non-allowed investments and transactions. Unlike Bitcoin and Litecoin, Ripple released all of its maximum currency, billion tokens, immediately. Retrieved 9 October There are generally two ways to purchase cryptocurrencies with IRA funds: Your email address will not be published. I discovered your site by accident! Recent Posts Understanding the importance of timing in trading business Buying Headphones: You will receive Join Link via email upon registration and receive periodic emails from us, which you can Unsubscribe from any time. Scout the market and read into what each wallet can offer you before you decide on which to use. Transactions are secured through multiple security features and confirmed by a peer-to-peer protocol on a blockchain network. Bitcoin IRA is a fintech service provider and as such is not a financial adviser, cryptocurrency, exchange, custodian, wallet provider, initial coin offering ICO , or money transmitter. This insurance extends to cold stored offline cryptocurrency assets. This page was last edited on 13 February , at Bitcoin and money image via Shutterstock. The upside of the self-directed IRA approach is more control, lower fees and less counter-party risk.

How to Buy Bitcoin with a 401(k): What You Need to Know

Best Customer Service. Working with a company known to be a trusted source for non-traditional IRAs makes BlockMint a good option for consumers that want to get into the world of cryptocurrencies. This article will explain some of the eligibility requirements to

bitcoin cash candle south african bitcoin exchange bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started. To learn even more, read about the full process of rolling over a k to a Bitcoin IRA. For more information, read our BlockMint review. Ripple is the corporate cryptocurrency, a contrast to other cryptocurrencies. The most important one is the expense of added fees and risk. Bitcoin and other cryptocurrencies like it have been the hot topic of debate in financial circles for the past 18 months or so. Thank you Bonnie. In he put the software out into the digital world and individuals have worked with the system since then, growing it into a global phenomenon based on a system of decentralized servers. Bitcoin IRA then requires government issued identification and voice verification to transfer funds. A bitcoin exchange

transaction is unconfirmed bitcoin coinbase more users than a virtual stock market where only bitcoins are bought and sold. What Is a Wallet?

Bitcoin is currently the highest valued cryptocurrency. And I predict it will be the first brokerage to allow the trading of cryptocurrencies directly. A Bitcoin wallet is required in order to store, buy and sell your Bitcoins, many different companies offer digital wallets like these, but it is important for you to remember that they are not all the same. But you also have an enormous advantage when you buy bitcoin for your IRA and sell it later while keeping your funds within your account. Some wallet companies are now providing self-contained hard drives, much like a thumb drive, that holds all of your account data and encryption. Finding a Self-Directed IRA custodian can take some time as many of the banks and financial companies you may be familiar with do not handle this type of IRA. But there are also a number of other details to consider before deciding to roll over your k into a Bitcoin IRA. Litecoin is a cryptocurrency that is nearly identical to Bitcoin regarding transfer and coding but is faster and cheaper. Tips for a Wise Cryptocurrency IRA Buyer Cryptocurrency is a relatively new form of investment, so here are some things to think about. Bitcoin IRA does not directly provide any of these services. There are also recurring custody and maintenance fees charged by providers of such services. What You Need to Know. Furthermore, commissions are imposed on each side of the transaction. Matching orders are put together between bidders and sellers by a cryptocurrency broker. Coin IRA. This is called adaptive scaling. Officials with the IRS have started compiling data on alternative investments in IRAs, including cryptocurrencies, and said in statements they plan to release findings sometime this year. Retrieved 13 October As one of the things that you can do to avoid this, roll some of your k into a Bitcoin IRA to protect yourself. Then, your Digital Currency Specialist can help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot more. A bitcoin exchange is a virtual stock market where only bitcoins are bought and sold. BlockMint offers experienced guidance and secure, easy-to-use tools that make the process of setting up a Cryptocurrency IRA easier. Bitcoin IRA then requires government issued identification and voice verification to transfer funds. Then there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. Most articles will contain actionable advice. Each of these companies stood out from the rest in different ways. Investors cannot purchase cryptocurrency through an open exchange or move previously-purchased cryptocurrency into their IRA account.

Uptick in interest

There are also recurring custody and maintenance fees charged by providers of such services. Because firms offering self-directed IRA services are not bound by broker fiduciary duties, investors are on the hook if they do not assess risks associated with crypto markets. Just like any other traditional retirement account, cryptocurrency IRAs come with benefits. Tips for a Wise Cryptocurrency IRA Buyer Cryptocurrency is a relatively new form of investment, so here are some things to think about. Plus, you get to maintain complete control of your investments. Indeed, if there is one asset class well suited for retirement savings products like IRAs, it might be deflationary cryptocurrencies like bitcoin, which increase in value over time. To be sure, those savings can be substantial since a capital gains tax, amounting to between 15 percent and 20 percent, may be applied to all cryptocurrency trades. But this year has been a mixed bag for bitcoin. In order to get past this issue, you either need to have been offered Bitcoin directly from your IRA provider or alternatively change your IRA to a self-directed IRA, an identical account to a captive account, with the exception that it will not have heavy limits on investments. Another big difference comes down to the fees and the terms of use, for example some will offer you the chance to buy Bitcoin cheaper than market value, but this often comes with the catch that you must invest in mining products or you will have length fulfillment orders. BitIRA Security. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. And I predict it will be the first brokerage to allow the trading of cryptocurrencies directly. Bitcoin IRA does not directly provide any of these services. Bitcoin IRA does not directly provide any of these services, however, they do facilitate the setup and transfer of funds to Kingdom Trust IRA accounts. Bitcoin and other cryptocurrencies like it have been the hot topic of debate in financial circles for the past 18 months or so. Before one decides to purchase cryptocurrencies, such as Bitcoins, with a self-directed IRA, there are three main items to keep in mind:. Stay up to date on news for retirees and seniors: Internal Revenue Service. Get a list of fees and services from each company you are considering before investing. Contact him via email at adamb irafinancialgroup. The ability to buy Bitcoin in an IRA is supported, but not plainly endorsed, through a IRS ruling [4] that clarified the tax treatment for Bitcoins as non-currency personal property which is similar to stocks, and presumably compatible with IRA's. Even with discounts, however, the prospect of entering a volatile space riddled with scams entirely at your own risk may not be an attractive one for most investors. And the price does not necessarily move exactly with Bitcoin. Gains you accrue can be retained tax-free until you take a distribution. The custodian could be a bank, credit union, trust, or another company called a non-bank custodian. Recently there was a dive in Ripple pricing. Bitcoin IRA uses a full-service model connecting clients to complete these transactions through its business partners Custodian, Exchange, and Digital Wallet for a fee. However, this unregulated frontier is being seriously considered by some countries as needing regulation, and the US began taxing cryptocurrency gains in as property instead of currency. Finding a Self-Directed IRA custodian can take some time as many of the banks and financial companies you may be familiar with do not handle this type of IRA.

Coin IRA is

bitcoin economics cryptography litecoin white pap er facilitator company, meaning they are not an exchange, bank, custodian, or wallet themselves but they handle the communication between these entities and the investor. All cryptocurrencies become harder to get as supply increases. We evaluated 12 cryptocurrency IRA companies to choose our top four picks. The customer needs only to call them to begin a transaction, and then Coin IRA manages the rest of the process. On top of that, IRS guidelines allow these sorts of IRAs to invest in a complete assortment of different assets, including bitcoin. In an interview earlier this year, Bitcoin IRAone of the earliest providers in this space, claimed that it had already signed up 4, people for its service. Kline told CoinDesk: Then there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. That is now less and less the case. A Bitcoin wallet is required in order to store, buy and sell your Bitcoins, many different companies offer digital wallets like these, but it is important for you to remember that they are not all the. Limit inflation Adaptive scaling of digital currency makes artificially inflating supply impossible. The general rule of thumb is that you established your k as a full-time employee from a previous employer, or you are more than Languages Add links. Ethereum supplies a software wallet rather than relying purely on third-party programmers for security and storage. Ripple is the corporate cryptocurrency, a

i want to put bitcoins in my wallet dollar to ethereum to other cryptocurrencies. Bitcoin IRA. Finding a Self-Directed IRA custodian can take some time as many of the banks and financial companies you may be familiar with do not handle this type of IRA. Transactions are secured through multiple security features and confirmed by a peer-to-peer protocol on a blockchain network. The resource page offers information about factors that affect the price of Bitcoin, real-time pricing charts for Bitcoin, Ethereum, Ripple and Litecoin, and a cryptocurrency news

best bitcoin mining machine club 9 bitcoin. As long as your digital currency is being held in a cryptocurrency IRA, its growth is tax-deferred. Skip to content. Your email address will

bitstamp wire transfer withdrawal kucoin shares kcs be published. Login Advisor Login Newsletters. We are fully prepared to help you convert your k savings to bitcoin quickly and easily. You will receive Join Link via email upon registration and receive periodic emails from us, which you can Unsubscribe from any time. Ripple has worldwide offices and markets itself to banks and other financial companies as

the silk road bitcoin wallet create paper bitcoin wallet secure digital currency with lower fees. IRA custodians, such as some banks or credit unions, offer only certain investments in stocks, bonds or mutual funds. Coin IRA has a very informative website containing bitcoin IRA rules, benefits, current cryptocurrency pricing and a resource section.

Retrieved 9 October The ability to buy Bitcoin in an

Unpaid balance ethereum import bitstamp price into excel is supported, but not plainly endorsed, through a IRS ruling [4] that clarified the tax treatment for Bitcoins as non-currency personal property which is similar to stocks, and presumably compatible with IRA's. Bitcoin and money image via Shutterstock. BlockMint Live Pricing. Lowest Minimum Inevestment. They understand that this is a new investment opportunity,

affordable crypto mining rigs which current gpu have terrible cryptocurrency mining consumers are bound to have questions. Any retirement account investor interested in using retirement funds to invest in cryptocurrencies should do their diligence and proceed with caution. Our three best cryptocurrency IRA companies present solid options for balanced retirement investments with security features along with ease of transaction process. Can I transfer retirement accounts beside a k? Investors could invest entirely in one coin or a percentage of both coins. Retrieved 11 September — via www. Finally, keep your cryptocurrency stored in a cold wallet — that is, offline until you are ready to buy or sell. Frequent questions that they can answer include: Read about the top four Bitcoin IRA companies and information on

transfer from coinbase using qr bitstamp wire usa different types of cryptocurrency. In an interview earlier this year, Bitcoin IRAone of the earliest providers in this space, claimed that it had already signed up 4, people for its service.

Hope it helps. In this guide, we will discuss what cryptocurrency is, how to use it as an IRA asset, the options available to the consumer, and our reviews of our top three choices. Self-Directed IRA custodians will allow investors to invest retirement funds in other types of assets such as real estate, promissory notes, private placement securities, and even cryptocurrencies. Fidelity embraces cryptocurrency Unfortunately, for now, the only mainstream brokerage firm I know of that offers it is Fidelity. Research cryptocurrency thoroughly and be sure your portfolio balances the risk associated with a new investment type. Fees for bitcoin trading take on various forms during the investment process, from initial setup fees to custody and trading fees to annual maintenance fees. Best Customer Service. The only guidance on cryptocurrency is that it is taxable under property rules, which does not prohibit cryptocurrency as an IRA retirement account investment. The resource page offers information about factors that affect the price of Bitcoin, real-time pricing charts for Bitcoin, Ethereum, Ripple and Litecoin, and a cryptocurrency news section. Speak with companies you consider to see who can best explain the process and the different types of cryptocurrency in a way that is easy to understand. You get to leverage the power of the blockchain with fast, secure, peer-to-peer confirmation and mediation. Lowest Minimum Investment. Fund Scan". Blaskey says their average customer type has changed from previous years. There are generally two ways to purchase cryptocurrencies with IRA funds: A cryptocurrency exchange is a virtual stock market where cryptocurrency from several companies is the only investment offered. Even with discounts, however, the prospect of entering a volatile space riddled with scams entirely at your own risk may not be an attractive one for most investors. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. Up until recently, you only had two options for owning Bitcoin in your IRA: Retrieved 11 September Login Advisor Login Newsletters.

Cryptocurrency IRA investors should have the financial ability to bear the risks of a cryptocurrency investment, and a potential total loss of their investment. Each of these companies stood out from the rest in different ways. Be aware that some cryptocurrency IRA companies only work with specific custodians so if you wish to work with a particular facilitator you will need ira custodian bitcoin when you buy bitcoin at one price then sell it ask which custodians they partner with. On top of that, IRS guidelines allow these sorts of IRAs to invest in how to use bitcoin on steam to to mine bitcoin cash complete assortment of different assets, including bitcoin. Working with a company known to be a trusted source for non-traditional IRAs makes BlockMint a good option for consumers that want to get into the world of cryptocurrencies. Bitcoin IRA is a fintech service provider and as such is not a financial adviser, cryptocurrency, exchange, custodian, wallet provider, initial coin offering ICOor money transmitter. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Login Advisor Login Newsletters. But increasingly, Kline said, he has seen inquires from people who were less interested in the technology and were instead motivated by the uptrends in digital currency prices. How To Buy A Bitcoin IRA or Cryptocurrency IRA Bittrex fork support buy bitcoin credit card iran cryptocurrency was often purchased directly from a cryptocurrency company when it first appeared on the markets, it is no longer common to make this type of transaction due to the complexity of the computing behind the currencies. Frequent questions that they can answer include:. Their website has a lot of information like investor kits that completely explain their three-step process involved with setting up a cryptocurrency IRA. I discovered your site by accident! Namespaces Article Talk. The software has the potential for being a platform for transferring anything of value, such as property or content. If the idea of using your IRA to fund a cryptocurrency IRA appeals to you, here is how to go about getting it started. Diversification Unlike other traditional withdraw from coinbase to bank account bitcoin economist view savings plans, your investments are opened to more than just stocks and mutual funds. Bitcoin IRA uses only BitGo as its digital wallet and security provider for cryptocurrency retirement assets. Yet an increasing number of financial services firms now offer the option of investing in the cryptocurrency through self-directed IRA accounts. Kim Snider on September 18, at 4: Submit a Comment Cancel reply Your email address will not be published. Get a list of fees and services from each company you are considering before investing. As you probably know, when it comes to investments, you should never put all of your eggs in one basket. We found the BlockMint representatives to be both knowledgeable and patient with questions. Cryptocurrency investments, ripple transaction explorer bitcoin past fork dates as Bitcoins, are uncertain and highly volatile. Most articles will contain actionable advice. Bitcoin is the largest and most well-known cryptocurrency currently in use. Ripple is the corporate cryptocurrency, a contrast to other cryptocurrencies. By overseeing one of the largest networks of trading partners in the cryptocurrency market, they ensure that when you buy and sell bitcoin, the transaction is completed with extreme speed. Kline also stated that, considering the growth of cryptocurrencies, expects cryptocurrencies to one day be as commonly held in IRAs as stocks or bonds.

Cryptocurrency IRA investors should have the financial ability to bear the risks of a cryptocurrency investment, and a potential total loss of their investment. Each of these companies stood out from the rest in different ways. Be aware that some cryptocurrency IRA companies only work with specific custodians so if you wish to work with a particular facilitator you will need ira custodian bitcoin when you buy bitcoin at one price then sell it ask which custodians they partner with. On top of that, IRS guidelines allow these sorts of IRAs to invest in how to use bitcoin on steam to to mine bitcoin cash complete assortment of different assets, including bitcoin. Working with a company known to be a trusted source for non-traditional IRAs makes BlockMint a good option for consumers that want to get into the world of cryptocurrencies. Bitcoin IRA is a fintech service provider and as such is not a financial adviser, cryptocurrency, exchange, custodian, wallet provider, initial coin offering ICOor money transmitter. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Login Advisor Login Newsletters. But increasingly, Kline said, he has seen inquires from people who were less interested in the technology and were instead motivated by the uptrends in digital currency prices. How To Buy A Bitcoin IRA or Cryptocurrency IRA Bittrex fork support buy bitcoin credit card iran cryptocurrency was often purchased directly from a cryptocurrency company when it first appeared on the markets, it is no longer common to make this type of transaction due to the complexity of the computing behind the currencies. Frequent questions that they can answer include:. Their website has a lot of information like investor kits that completely explain their three-step process involved with setting up a cryptocurrency IRA. I discovered your site by accident! Namespaces Article Talk. The software has the potential for being a platform for transferring anything of value, such as property or content. If the idea of using your IRA to fund a cryptocurrency IRA appeals to you, here is how to go about getting it started. Diversification Unlike other traditional withdraw from coinbase to bank account bitcoin economist view savings plans, your investments are opened to more than just stocks and mutual funds. Bitcoin IRA uses only BitGo as its digital wallet and security provider for cryptocurrency retirement assets. Yet an increasing number of financial services firms now offer the option of investing in the cryptocurrency through self-directed IRA accounts. Kim Snider on September 18, at 4: Submit a Comment Cancel reply Your email address will not be published. Get a list of fees and services from each company you are considering before investing. As you probably know, when it comes to investments, you should never put all of your eggs in one basket. We found the BlockMint representatives to be both knowledgeable and patient with questions. Cryptocurrency investments, ripple transaction explorer bitcoin past fork dates as Bitcoins, are uncertain and highly volatile. Most articles will contain actionable advice. Bitcoin is the largest and most well-known cryptocurrency currently in use. Ripple is the corporate cryptocurrency, a contrast to other cryptocurrencies. By overseeing one of the largest networks of trading partners in the cryptocurrency market, they ensure that when you buy and sell bitcoin, the transaction is completed with extreme speed. Kline also stated that, considering the growth of cryptocurrencies, expects cryptocurrencies to one day be as commonly held in IRAs as stocks or bonds.

When clients invest in cryptocurrency using an Exchange, they will need to go through a self-directed IRA and would require a custodian and a digital wallet. Then, your Digital Currency Specialist coinbase btc usd limits cex.io high rate help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot. And the price does not necessarily move exactly with Bitcoin. Unlike other traditional retirement savings plans, your investments are opened to more than just stocks and mutual funds. What Is a Wallet? BitIRA Security. I discovered your site by accident! Get exclusive content, advice and tips from Retirement Living delivered to your inbox. But increasingly, Kline said, he has seen inquires from people who were less interested in the technology and were instead motivated by the uptrends in digital currency prices. Fees for bitcoin trading take on various forms litecoin feed ripple company valuation the investment process, from initial setup fees to custody and trading fees to annual maintenance fees. Any retirement account investor interested in using retirement funds to invest in cryptocurrencies should do their diligence and proceed with caution. Bitcoin has made big strides recently toward mainstream adoption, including a new way to buy Bitcoin in your IRA. For one, the hour market structure requires investors profit mining ethereum profitability calculator bitcoin mining think about the daily price changes in their positions through a different conceptual lens than their stock portfolios. The general rule of thumb is that you established your k as a full-time employee from a previous employer, or you are more than However, this unregulated frontier is being seriously considered by some countries as needing regulation, and the US began taxing cryptocurrency gains in as property instead of currency. Holders of IRAs can deduct contributions from their income tax every year until the commencement of disbursements, currently at This is called adaptive scaling. Security Transactions are secured through multiple security features ira custodian bitcoin when you buy bitcoin at one price then sell it confirmed by a peer-to-peer protocol on antminer s7 noise antminer s7 production per month blockchain network. The opportunity has grown in the last year. Accordingly, just like stocks and real estate, cryptocurrencies may be purchased with retirement funds.

They understand that this is a new investment opportunity, so consumers are bound to have questions. It involves setting up an LLC and bank account, multiple asset transfers, annual reporting of your balances to the custodian, etc. But this year has been a mixed bag for bitcoin. The reason for this is that a traditional IRA is classed as a captive account, with heavy limits on investments. The downside is you will spend some money to set this structure up. Thank you Bonnie Reply. The software has the potential for being a platform for transferring anything of value, such as property or content. BlockMint works with a variety of digital coin offerings. To learn more, keep reading below, or watch the video here: Get a list of fees and services from each company you are considering before investing. However, the Internal Revenue Code does not specify what Self-Directed plans can invest in, only non-allowed investments and transactions. Unlike Bitcoin and Litecoin, Ripple released all of its maximum currency, billion tokens, immediately. Retrieved 9 October There are generally two ways to purchase cryptocurrencies with IRA funds: Your email address will not be published. I discovered your site by accident! Recent Posts Understanding the importance of timing in trading business Buying Headphones: You will receive Join Link via email upon registration and receive periodic emails from us, which you can Unsubscribe from any time. Scout the market and read into what each wallet can offer you before you decide on which to use. Transactions are secured through multiple security features and confirmed by a peer-to-peer protocol on a blockchain network. Bitcoin IRA is a fintech service provider and as such is not a financial adviser, cryptocurrency, exchange, custodian, wallet provider, initial coin offering ICO , or money transmitter. This insurance extends to cold stored offline cryptocurrency assets. This page was last edited on 13 February , at Bitcoin and money image via Shutterstock. The upside of the self-directed IRA approach is more control, lower fees and less counter-party risk.

When clients invest in cryptocurrency using an Exchange, they will need to go through a self-directed IRA and would require a custodian and a digital wallet. Then, your Digital Currency Specialist coinbase btc usd limits cex.io high rate help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot. And the price does not necessarily move exactly with Bitcoin. Unlike other traditional retirement savings plans, your investments are opened to more than just stocks and mutual funds. What Is a Wallet? BitIRA Security. I discovered your site by accident! Get exclusive content, advice and tips from Retirement Living delivered to your inbox. But increasingly, Kline said, he has seen inquires from people who were less interested in the technology and were instead motivated by the uptrends in digital currency prices. Fees for bitcoin trading take on various forms litecoin feed ripple company valuation the investment process, from initial setup fees to custody and trading fees to annual maintenance fees. Any retirement account investor interested in using retirement funds to invest in cryptocurrencies should do their diligence and proceed with caution. Bitcoin has made big strides recently toward mainstream adoption, including a new way to buy Bitcoin in your IRA. For one, the hour market structure requires investors profit mining ethereum profitability calculator bitcoin mining think about the daily price changes in their positions through a different conceptual lens than their stock portfolios. The general rule of thumb is that you established your k as a full-time employee from a previous employer, or you are more than However, this unregulated frontier is being seriously considered by some countries as needing regulation, and the US began taxing cryptocurrency gains in as property instead of currency. Holders of IRAs can deduct contributions from their income tax every year until the commencement of disbursements, currently at This is called adaptive scaling. Security Transactions are secured through multiple security features ira custodian bitcoin when you buy bitcoin at one price then sell it confirmed by a peer-to-peer protocol on antminer s7 noise antminer s7 production per month blockchain network. The opportunity has grown in the last year. Accordingly, just like stocks and real estate, cryptocurrencies may be purchased with retirement funds.

They understand that this is a new investment opportunity, so consumers are bound to have questions. It involves setting up an LLC and bank account, multiple asset transfers, annual reporting of your balances to the custodian, etc. But this year has been a mixed bag for bitcoin. The reason for this is that a traditional IRA is classed as a captive account, with heavy limits on investments. The downside is you will spend some money to set this structure up. Thank you Bonnie Reply. The software has the potential for being a platform for transferring anything of value, such as property or content. BlockMint works with a variety of digital coin offerings. To learn more, keep reading below, or watch the video here: Get a list of fees and services from each company you are considering before investing. However, the Internal Revenue Code does not specify what Self-Directed plans can invest in, only non-allowed investments and transactions. Unlike Bitcoin and Litecoin, Ripple released all of its maximum currency, billion tokens, immediately. Retrieved 9 October There are generally two ways to purchase cryptocurrencies with IRA funds: Your email address will not be published. I discovered your site by accident! Recent Posts Understanding the importance of timing in trading business Buying Headphones: You will receive Join Link via email upon registration and receive periodic emails from us, which you can Unsubscribe from any time. Scout the market and read into what each wallet can offer you before you decide on which to use. Transactions are secured through multiple security features and confirmed by a peer-to-peer protocol on a blockchain network. Bitcoin IRA is a fintech service provider and as such is not a financial adviser, cryptocurrency, exchange, custodian, wallet provider, initial coin offering ICO , or money transmitter. This insurance extends to cold stored offline cryptocurrency assets. This page was last edited on 13 February , at Bitcoin and money image via Shutterstock. The upside of the self-directed IRA approach is more control, lower fees and less counter-party risk.

Best Customer Service. Working with a company known to be a trusted source for non-traditional IRAs makes BlockMint a good option for consumers that want to get into the world of cryptocurrencies. This article will explain some of the eligibility requirements to bitcoin cash candle south african bitcoin exchange bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started. To learn even more, read about the full process of rolling over a k to a Bitcoin IRA. For more information, read our BlockMint review. Ripple is the corporate cryptocurrency, a contrast to other cryptocurrencies. The most important one is the expense of added fees and risk. Bitcoin and other cryptocurrencies like it have been the hot topic of debate in financial circles for the past 18 months or so. Thank you Bonnie. In he put the software out into the digital world and individuals have worked with the system since then, growing it into a global phenomenon based on a system of decentralized servers. Bitcoin IRA then requires government issued identification and voice verification to transfer funds. A bitcoin exchange transaction is unconfirmed bitcoin coinbase more users than a virtual stock market where only bitcoins are bought and sold. What Is a Wallet?

Bitcoin is currently the highest valued cryptocurrency. And I predict it will be the first brokerage to allow the trading of cryptocurrencies directly. A Bitcoin wallet is required in order to store, buy and sell your Bitcoins, many different companies offer digital wallets like these, but it is important for you to remember that they are not all the same. But you also have an enormous advantage when you buy bitcoin for your IRA and sell it later while keeping your funds within your account. Some wallet companies are now providing self-contained hard drives, much like a thumb drive, that holds all of your account data and encryption. Finding a Self-Directed IRA custodian can take some time as many of the banks and financial companies you may be familiar with do not handle this type of IRA. But there are also a number of other details to consider before deciding to roll over your k into a Bitcoin IRA. Litecoin is a cryptocurrency that is nearly identical to Bitcoin regarding transfer and coding but is faster and cheaper. Tips for a Wise Cryptocurrency IRA Buyer Cryptocurrency is a relatively new form of investment, so here are some things to think about. Bitcoin IRA does not directly provide any of these services. There are also recurring custody and maintenance fees charged by providers of such services. What You Need to Know. Furthermore, commissions are imposed on each side of the transaction. Matching orders are put together between bidders and sellers by a cryptocurrency broker. Coin IRA. This is called adaptive scaling. Officials with the IRS have started compiling data on alternative investments in IRAs, including cryptocurrencies, and said in statements they plan to release findings sometime this year. Retrieved 13 October As one of the things that you can do to avoid this, roll some of your k into a Bitcoin IRA to protect yourself. Then, your Digital Currency Specialist can help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot more. A bitcoin exchange is a virtual stock market where only bitcoins are bought and sold. BlockMint offers experienced guidance and secure, easy-to-use tools that make the process of setting up a Cryptocurrency IRA easier. Bitcoin IRA then requires government issued identification and voice verification to transfer funds. Then there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. Most articles will contain actionable advice. Each of these companies stood out from the rest in different ways. Investors cannot purchase cryptocurrency through an open exchange or move previously-purchased cryptocurrency into their IRA account.

Best Customer Service. Working with a company known to be a trusted source for non-traditional IRAs makes BlockMint a good option for consumers that want to get into the world of cryptocurrencies. This article will explain some of the eligibility requirements to bitcoin cash candle south african bitcoin exchange bitcoin with your k funds by moving it into a Bitcoin IRA, show you the benefits of making this move, and describe the three steps that go into getting started. To learn even more, read about the full process of rolling over a k to a Bitcoin IRA. For more information, read our BlockMint review. Ripple is the corporate cryptocurrency, a contrast to other cryptocurrencies. The most important one is the expense of added fees and risk. Bitcoin and other cryptocurrencies like it have been the hot topic of debate in financial circles for the past 18 months or so. Thank you Bonnie. In he put the software out into the digital world and individuals have worked with the system since then, growing it into a global phenomenon based on a system of decentralized servers. Bitcoin IRA then requires government issued identification and voice verification to transfer funds. A bitcoin exchange transaction is unconfirmed bitcoin coinbase more users than a virtual stock market where only bitcoins are bought and sold. What Is a Wallet?

Bitcoin is currently the highest valued cryptocurrency. And I predict it will be the first brokerage to allow the trading of cryptocurrencies directly. A Bitcoin wallet is required in order to store, buy and sell your Bitcoins, many different companies offer digital wallets like these, but it is important for you to remember that they are not all the same. But you also have an enormous advantage when you buy bitcoin for your IRA and sell it later while keeping your funds within your account. Some wallet companies are now providing self-contained hard drives, much like a thumb drive, that holds all of your account data and encryption. Finding a Self-Directed IRA custodian can take some time as many of the banks and financial companies you may be familiar with do not handle this type of IRA. But there are also a number of other details to consider before deciding to roll over your k into a Bitcoin IRA. Litecoin is a cryptocurrency that is nearly identical to Bitcoin regarding transfer and coding but is faster and cheaper. Tips for a Wise Cryptocurrency IRA Buyer Cryptocurrency is a relatively new form of investment, so here are some things to think about. Bitcoin IRA does not directly provide any of these services. There are also recurring custody and maintenance fees charged by providers of such services. What You Need to Know. Furthermore, commissions are imposed on each side of the transaction. Matching orders are put together between bidders and sellers by a cryptocurrency broker. Coin IRA. This is called adaptive scaling. Officials with the IRS have started compiling data on alternative investments in IRAs, including cryptocurrencies, and said in statements they plan to release findings sometime this year. Retrieved 13 October As one of the things that you can do to avoid this, roll some of your k into a Bitcoin IRA to protect yourself. Then, your Digital Currency Specialist can help you complete paperwork, oversee rollovers, explain asset options, assist with contributions or distributions, offer ongoing support… and a whole lot more. A bitcoin exchange is a virtual stock market where only bitcoins are bought and sold. BlockMint offers experienced guidance and secure, easy-to-use tools that make the process of setting up a Cryptocurrency IRA easier. Bitcoin IRA then requires government issued identification and voice verification to transfer funds. Then there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. Most articles will contain actionable advice. Each of these companies stood out from the rest in different ways. Investors cannot purchase cryptocurrency through an open exchange or move previously-purchased cryptocurrency into their IRA account.